When you sell a property at a profit you have to pay Income Tax. The tax is levied on the appreciation of property which, in economic jargon, has a name: capital gain. It is the difference between the purchase value and the market value at the time the property is sold. And it starts at 15%.

But a law, passed in September, changed the rules of the game. Now, the appreciation of a property can be brought forward (without the need to sell the house) by paying a fixed rate of just 4%.

It works like this. If you paid R$100,000 for your apartment in the distant past, the right thing to do was to have declared this amount to the IRS every year since then – it doesn't matter that the market value of the apartment has risen to R$1 million. It is declared to be worth R$100,000.

And then… When you sell for R$1 million, you will pay 15% on R$900,000.

Under the new law (14.973/2024), you can update the value of the property to R$1 million, pay 4% on R$900 thousand, and that's it. If you sell up front for R$1 million, you won't pay capital gains tax (it's more complex than that, actually – follow this text to better understand the fine print of the law).

The measure exists because it is good for the government. Instead of waiting until the moment of sale to take 15%, you earn 4% in your 2025 declaration. A bird in the hand instead of two in the bush.

And the taxpayer, in order to receive this tax benefit, needs to hurry: there is even December 16 to carry out the procedure.

See what the tax incidence is like which e com the application of the new tax measure to properties:

Tax rates without reduction:

Individual: Of 15% a 22,5% Income Tax, which is levied on the capital gain earned by the property.

Legal Entity: the rates add up to 34% (depending on the taxation regime).

Tax rates with the reduction:

Individuals bear a tax rate of 4% IR;

Legal Entities now have two rates: 6% IRPJ (Corporate Income Tax) and 4% CSLL (Social Contribution on Net Profit).

Who is it worth it for?

Now, the fine print of the law. If you sell your apartment within 36 months (3 years), you will have to pay the full 15% IR on the capital gain – in addition to having already paid the 4%… Bad deal.

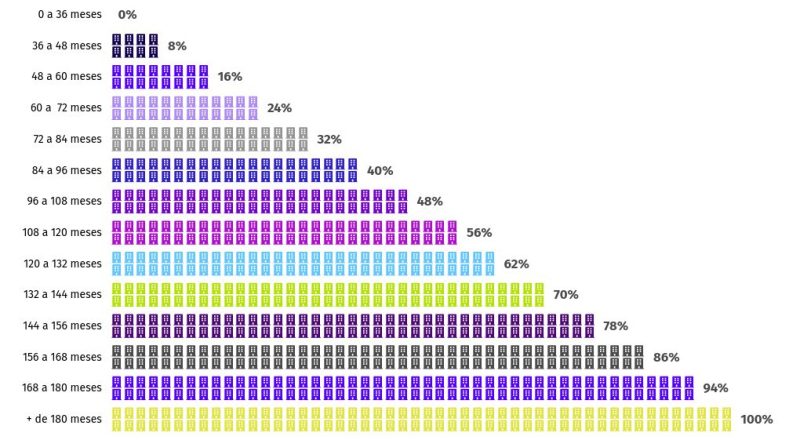

The calculation formula provided for in the new legislation starts with a 0% discount for sales occurring within 3 years. Then the cut in capital gains tax gradually increases. Only after a long 180 months does it reach 100% – that is, when there is no longer any tax on capital gains.

As José Luiz Ribeiro Brazuna, tax lawyer and founder of the Bratax firm, says: “The benefit will only be guaranteed in its entirety if the holder keeps the asset under their ownership for 15 years”.

For tax lawyer Georgios Anastassiadis, partner at Gaia Silva Gaede, the measure is advantageous for those who have had a property registered in the IR for a long time with a low value, but which has appreciated in value.

“There needs to be an expectation of continuous appreciation of the property. If there is a risk of devaluation, anticipating the tax could be a mistake, as the taxpayer would end up paying a tax that would not need to be paid in the future”, he says.

READ MORE: Is it more worth buying or renting property?

Anastassiadis also remembers that the taxpayer needs to have liquidity (cash on hand) to carry out the operation. “This is because the person is not selling the property at the moment, just updating the value to pay less tax in the future. Without a sale, there is no money coming in from the buyer, so resources must be available to pay the tax.”

For those who don't pay?

Taxpayers also need to compare the new legislation with existing exemption provisions and know when they will sell the property to calculate whether the discounts are worth it.

The new measure, for example, does not compensate for those who sell a property and buy another within an interval of up to 180 days because, in this case, there is tax exemption. This mechanism can be used every five years, according to article 39 of the Lei 11.196/2005 by you Normative Instruction 599/2005from the Federal Revenue Service.

The exemption is also guaranteed to owners who own a single property and sell it for up to R$440,000.

Inheritance property

The new legislation also affects properties in property succession processes. Each heir can update their share of the property, explains lawyer Daniela Poli Vlavianos, partner at Poli Advogados & Associados.

“The update must be carried out considering the value proportional to the fraction (obtained by the heir) in the property”, reinforces the specialist.

In this case, the heir must follow 4 steps, according to Daniela Vlavianos:

1. Valuate the property to determine its market value;

2. Prepare the documentation that proves the inheritance and the fraction you own of the property;

3. Request the update from the body responsible for tax administration in your location, generally the city hall;

4. Check if there is a need to pay any taxes due to the updated value (ITCMD, IPTU, ITBI and other administrative fees).

Tax specialist Juliana Assolari, from Lassori Advogados, also understands that co-owners are not required to update together.

“If an individual receives, for example, 50% of a property worth R$100 thousand and wishes to update the value to R$500 thousand, I understand that it is possible, even if the co-owner decides not to carry out the update”, he says Assolari. “The (requirement) to obtain the benefit is that the taxpayer has declared the property in their Income Tax”.

Property abroad

According to the Federal Revenue, the measure also applies to properties abroad. “Properties that are part of entities controlled abroad and assets of trust can be updated, as long as the individual is responsible for declaring these assets”, explains the agency.

How to update the property value?

You need to issue a declaration, the I give (Declaration of Option to Update Real Estate).

Where? Node e-CAC (Virtual Service Center), from the Federal Revenue Service. To access the system, you need an account Gov.br silver or gold level.

In addition to formalizing the declaration, you will have to pay the tax. The Revenue says that the updated price of the property will be considered on the date of presentation of Dabim or payment.

You can simulate the rules of the new measure by hiring a tax specialist. It is important to remember: updating the value of properties requires a detailed prior assessment because, once done, there is no going back.