It is perhaps the most audacious attempt yet on Wall Street to harness new artificial intelligence tools to mimic the strategies of finance legends.

A startup de fintech Intelligent Alpha is launching an exchange-traded fund that promises to use chatbots to replicate the brainpower of the world's most illustrious investment minds, including billionaires Warren Buffett, Stanley Druckenmiller, David Tepper and others.

Called the Intelligent Livermore ETF, the fund is built around investment ideas generated by generative artificial intelligence tools ChatGPT, Gemini and Claude, nicknamed the “investment committee,” and inspired by the thoughts and actions of famous investors.

READ MORE: Warren Buffett: $270 billion 'sitting in checking account' awaiting a destination

The company will instruct large language models to emulate the personalities of investors. The trio of chatbots will choose 60 to 90 global companies spanning multiple industries, themes and geographies, including healthcare, renewable energy and Latin America, to name a few.

The list of big names targeted by the ETF — in addition to Buffett, Druckenmiller and Tepper — will also include Dan Loeb and Paul Singer, among others, although the fund's allocations may not necessarily reflect the actual stakes of these big investors.

“If you think about the hedge fund world today, there are groups that focus on specific areas of expertise,” said Doug Clinton, CEO and founder of Intelligent Alpha. “In some ways, we’re recreating the basics of that structure, where we have these different inspirations from investors that we really respect.”

While the product’s ambitions stand out as particularly bold — even for the world of ETFs — it’s the latest attempt by Wall Street to use AI as a tool to generate wealth for investors of all stripes. Some leveraged funds already use chatbots for research and investment processes, and say AI can significantly reduce the time spent on monotonous tasks.

There is little evidence that AI is displacing investment units en masse, and much remains to be resolved when it comes to problems like chatbots making things up in their responses.

There’s also no evidence yet that AI-driven investments have an edge over passive investing. Of the 16 AI-focused ETFs in the U.S. tracked by Bloomberg Intelligence, only one has narrowly outperformed the S&P 500 this year: the Franklin Intelligent Machines ETF. The fund has returned 19% while the benchmark U.S. stock index has gained 18% through its last close.

Furthermore, only one — the Global X Artificial Intelligence & Technology ETF — has attracted significant inflows, raising more than $1 billion this year. The runner-up, the Roundhill Generative AI & Technology ETF, has attracted $117 million. The rest have seen small positive or negative inflows year to date.

Intelligent Alpha’s Clinton says many of the other AI-based ETFs tend to rely on traditional machine learning techniques and may not yet have incorporated large language models like his fund. “This limits these strategies to a crowded market for quantitative insights,” he said.

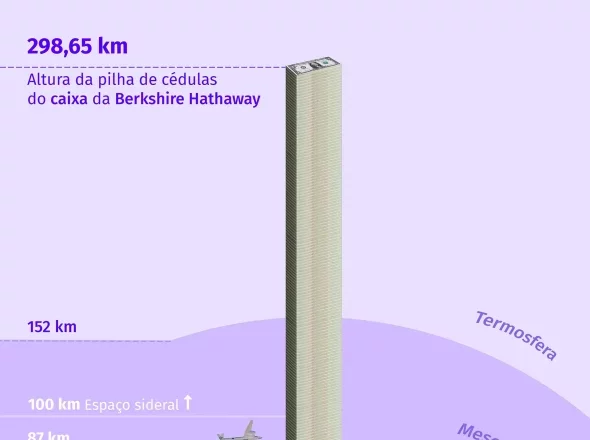

READ MORE: Warren Buffett's Berkshire is the first non-tech company to be worth over $1 trillion

The new ETF pays homage to Jesse Livermore — one of the most legendary equity traders of the early 20th century. The fund has human oversight.

“Just to make sure that there’s not some kind of hallucination in the portfolio, like a company that’s committed fraud or some blatant issue,” Clinton said. “And also that the portfolio meets any regulatory or compliance constraints that we’re aware of that the AIs may not be seeing when they’re creating the portfolio.”